Negotiable Certificate Of Deposit

- Negotiable Certificates Of Deposit Quizlet

- Negotiable Certificate Of Deposit Singapore

- Negotiable Certificate Of Deposit In The Philippines

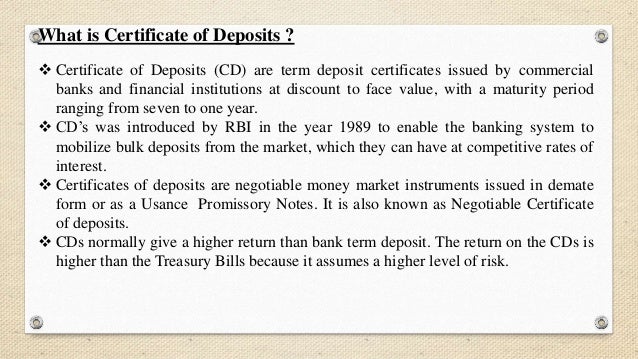

Basically, the negotiable certificate of deposit (NCD) refers to the certificate of deposit with the minimum par value of although typically. A negotiable certificate of deposit (CD) is a bank-issued time deposit that specifies an interest rate and maturity date and is negotiable (i.e., salable) in the secondary market. A negotiable CD is a bearer. Negotiable certificate of deposit, usually abbreviated to NCD, is a fixed deposit receipt issued by a bank that is negotiable in the secondary market for financial assets.

Non-Negotiable CDs–what are they?

CDs can offer investors a brighter financial future than they ever thought possible. Investors have the safety in knowing that their investment will grow over the terms of their original agreement. Unlike some other investments, investors know that no matter what happens their principle amount of money invested is safe and available to them when they need it. Non-negotiable CDs are one of the many types of CDs that may interest investors. They are great investment opportunities in which wise investors invest their money.

How do Non-Negotiable Certificate of Deposit CDs Work?

Non-negotiable CDs are investments between an investor and a financial institution. Investors must first select a certain amount of money to invest, terms, and interest rates. Once these factors are selected, investors open the CD account according to the agreement. The one difference is that non-negotiable CDs cannot be transferred, sold, bought, or exchanged.

Negotiable Certificates Of Deposit Quizlet

Investors who invest money in negotiable CDs do have the right to transfer, sell, buy, or exchange the CDs. Investors are able to withdraw the money early from non-negotiable CDs, but they have to pay penalties to do so. Some issuers charge 3 to 6 months of interest to withdraw funds from CDs.

Advantages of Non-Negotiable Certificate of Deposit CDs

- They are safe investment ventures. Non-negotiable CDs are not a huge gamble for investors. They are a safe place for investors to put their money until they need it. Investors know that no matter what happens they will leave with the principle amount that they invested.

- They are flexible investments. Investors have many options with non-negotiable CDs. CDs are not an investment venture that the issuer controls. Investors have control over the terms and the interest rates. CD rates are very competitive so investors have the freedom to open CD accounts with any financial institution that they desire. Investors may even be about to negotiable higher interest rates that are higher than rates available at certain financial institutions.

- They are low investment ventures. It doesn’t take a large amount of money to buy non-negotiable CDs. Investors can purchase most CDs for as little as $500. Some financial institutions may have a minimum deposit amount of $1000. There are a few financial institutions that they do not have a minimum deposit amount. Investors have many choices for where they put their money.

- Investors gain a profit. Investors gain money while their money sits in non-negotiable CDs. Even with low interest rates, investors receive profits. Investors also have the option to receive the interest on a monthly or yearly basis. Some investors have the money deposited directly into their accounts. Even if the money sits in CDs, investors can still benefit from the interest.

Disadvantages of Non-Negotiable Certificate of Deposit CD

- They have no liquidity. Once investors put their money into non-negotiable CDs, they are stuck with the investment until the maturity date. There is not the option to sell, buy, transfer, or exchange non-negotiable CDs. Some investors sell other forms of CDs for a larger profit, but this option is not possible with non-negotiable CDs.

- They have low gains. The interest rates on non-negotiable CDs are lower than other investment types such as money market accounts and the stock market. Although investors gain money on their investment, they gain a lower amount of money than riskier investment types. CDs are intended as long-term investments to earn gains.

- Investors may lose money over time. Non-negotiable CDs lock in investors at a certain rate over a certain amount of time. Investors may lose money if the market rates increase before the maturity date of their CDs. Investors may also lose money if the market rate increases before the maturity date. CD rates are determined by the conditions of the economy, housing market, and stock market. It is extremely hard to tell which direction the rates will go during the terms of existing CDs.

- Investors may have penalty fees for early withdrawal. Since investors cannot sell, buy, transfer, or exchange non-negotiable CDs, they may be left with no choice but to withdraw the funds if they need the funds. Fees can add up to as much as 3 to 6 months of interest. Investors lose a nice piece of their interest to withdraw their money.

Non-negotiable CDs are wonderful investment options. Although investors cannot sell, buy, transfer, or exchange their CDs, they can still make a profit on their investments. Investors have many choices when it comes to their investment needs. Invests should invest wisely in non-negotiable CDs.

Negotiable Certificate Of Deposit Singapore

Also known as NCDs, negotiable certificates of deposit are fixed deposit receipts that can be sold in a secondary market. Unlike other CDs, this type is structured so that the holder of the security can sell it to a third party. Like all types of CDs, it cannot be cashed until the security has reached full maturity, even if the asset is sold.

Negotiable Certificate Of Deposit In The Philippines

Most banks that offer the option of a negotiable certificate of deposit require that the security has a minimum face value. While the minimum face value required is generally $100,000 in United States dollars (USD), it is more common for this type of CD to carry a value of $1 million USD or more. In addition, the terms related to this type of investment normally provide for interest payments to be applied every six months, up to the point that the security reaches maturity.

The bank issuing this type of investment product normally guarantees the security, and is likely to arrange for its sale on a secondary market. Large institutions are the most common buyers of this type of CD, and may use the asset as a means of generating some amount of additional return on the money invested in the purchase of the negotiable certificate of deposit, while not tying up those funds for extended periods of time. Generally, the strategy is to acquire the CD when it has no more than a year left to reach full maturity, thus allowing the new owner to enjoy a decent return in a relatively short period of time.

Because a negotiable certificate of deposit can be sold repeatedly, an owner can choose to offer the asset on a secondary market as a means of generating quick cash in the event of an emergency. For example, if a business that had invested in several NCDs should suddenly need money to rebuild production facilities that were damaged during a flood or other natural disaster, it would be possible to sell those assets and use the money to effect the repairs, without using a line of credit or waiting for any resulting insurance claims to be settled. While losing on some of the projected return associated with the assets, the company may find that selling the NCDs is the most cost-effective way to restore operations and protect the profit margins of the business. This is particularly true if the alternative would be to create debt that would carry a higher rate of interest than the interest lost by selling the NCDs.