Bank Of Melbourne Term Deposit Rates

It's no secret that the current interest rates for both savings accounts and term deposits aren't exactly groundbreaking.

- Bank Of Melbourne Smsf Term Deposit Rates

- Bank Of Melbourne Term Deposit Rates Ontario

- Which Bank Has The Best Term Deposit Rate In Australia

- Which Bank Has The Best Term Deposit Rates

- Bank Of Melbourne Term Deposit Rates

- Bank Of Melbourne Term Deposit Rates Nyc

- Award Winning Term Deposit. Australian Government Guarantee - Under the Financial Claims Scheme, deposits are protected up to a limit of $250,000 for each account holder at Judo Bank, for more.

- This is because interest rates on term deposits are fixed and your money is protected under the Government Deposit Guarantee for balances up to $250,000. Which banks have the best term deposit rates in Australia? There is no one Australian bank that has the best term deposit rates for every investment term.

Term deposit interest rates are subject to frequent market change. To view the most current AMP Bank business term deposit rates, it’s best to view the provider’s website directly. If you want to earn competitive rates on your fixed deposits for an amount between $100,000 and $500,000, AMP Bank deposit may worth considering. Term Deposit Terms and Conditions. Interest rates are current as at 8am Date Display Widget (C#) 02-Mar-2021 and subject to change. The above rates are based on interest paid at maturity for terms up.

In 2011, deposit products offered well over 6%pa. Fast-forward to 2019 and it's rare to find a term deposit that returns more than 3%pa on your savings.

However, there are a few that do. Generally, the best rates are for longer terms and for larger deposits; however, there are a few offering above 3%pa on deposits of just $1000.

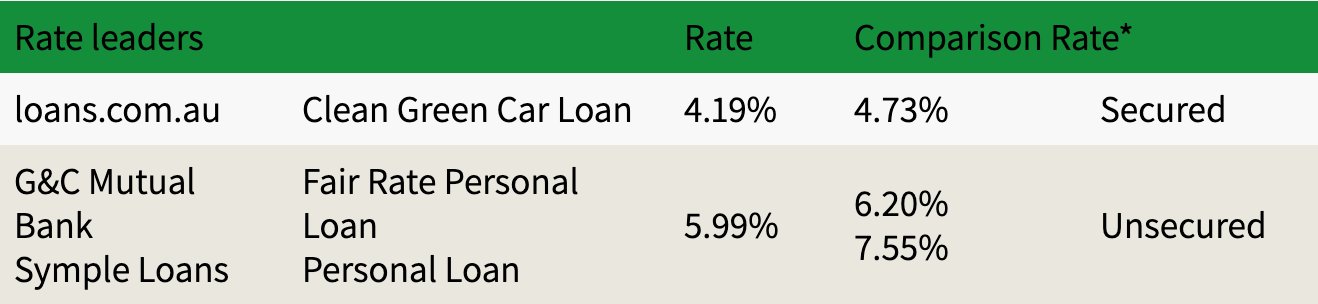

Here are five of the best term deposit rates in the market today.

So rates aren't what they were in 2011 but term deposits still have their place and they offer a number of benefits to savers and investors, even in this low-rate environment.

Five benefits of term deposits

1. They're low risk

Term deposits are a safe, low-risk way to invest your money. Your deposit, up to $250,000, is covered by the Australian Government guarantee scheme, so if the bank were to go under term deposit holders would be paid back ahead of shareholders.

For investors, term deposits are a great option if you're looking for some low-risk, defensive assets to add to your portfolio.

2. They offer predictable returns

Term deposits offer a fixed interest rate, unlike savings accounts, which have a variable rate that could change at any time.

Because the rate on your term deposit is fixed for the life of the term, if interest rates fall lower your rate will remain unchanged. It also means you can predict the return on your initial deposit down to the dollar, which is helpful for both peace of mind and budgeting.

3. They prevent you from dipping into your savings

Unlike money in a savings account, which you can withdraw whenever you need, term deposits are locked in until they mature.

This is a good option if you find yourself regularly dipping into your savings for impulse purchases.

4. There are no ongoing conditions to meet

Savings accounts often have monthly deposit conditions to earn the bonus interest rate, and if you don't meet the conditions you're often left with little to no interest. Term deposits have no ongoing conditions to meet, making them a great set-and-forget savings strategy.

5. They're flexible

Bank Of Melbourne Smsf Term Deposit Rates

Term deposits aren't a one-size-fits-all product. You can choose one that's locked in for just one month or up to five years.

You can also choose how you'd like to receive your interest, whether it's monthly, twice a year, annually or in a lump sum at maturity. You can choose whatever suits your financial needs.

Term deposits don't offer the big capital growth that you might experience with some high-risk shares or even property but they do provide a safe and secure place to park your savings while you enjoy guaranteed, risk-free returns.

It's no secret that the current interest rates for both savings accounts and term deposits aren't exactly groundbreaking.

In 2011, deposit products offered well over 6%pa. Fast-forward to 2019 and it's rare to find a term deposit that returns more than 3%pa on your savings.

However, there are a few that do. Generally, the best rates are for longer terms and for larger deposits; however, there are a few offering above 3%pa on deposits of just $1000.

Here are five of the best term deposit rates in the market today.

So rates aren't what they were in 2011 but term deposits still have their place and they offer a number of benefits to savers and investors, even in this low-rate environment.

Five benefits of term deposits

1. They're low risk

Term deposits are a safe, low-risk way to invest your money. Your deposit, up to $250,000, is covered by the Australian Government guarantee scheme, so if the bank were to go under term deposit holders would be paid back ahead of shareholders.

For investors, term deposits are a great option if you're looking for some low-risk, defensive assets to add to your portfolio.

2. They offer predictable returns

Term deposits offer a fixed interest rate, unlike savings accounts, which have a variable rate that could change at any time.

Because the rate on your term deposit is fixed for the life of the term, if interest rates fall lower your rate will remain unchanged. It also means you can predict the return on your initial deposit down to the dollar, which is helpful for both peace of mind and budgeting.

Bank Of Melbourne Term Deposit Rates Ontario

3. They prevent you from dipping into your savings

Unlike money in a savings account, which you can withdraw whenever you need, term deposits are locked in until they mature.

This is a good option if you find yourself regularly dipping into your savings for impulse purchases.

4. There are no ongoing conditions to meet

Savings accounts often have monthly deposit conditions to earn the bonus interest rate, and if you don't meet the conditions you're often left with little to no interest. Term deposits have no ongoing conditions to meet, making them a great set-and-forget savings strategy.

5. They're flexible

Which Bank Has The Best Term Deposit Rate In Australia

Term deposits aren't a one-size-fits-all product. You can choose one that's locked in for just one month or up to five years.

Which Bank Has The Best Term Deposit Rates

You can also choose how you'd like to receive your interest, whether it's monthly, twice a year, annually or in a lump sum at maturity. You can choose whatever suits your financial needs.

Bank Of Melbourne Term Deposit Rates

Term deposits don't offer the big capital growth that you might experience with some high-risk shares or even property but they do provide a safe and secure place to park your savings while you enjoy guaranteed, risk-free returns.